Small and medium sized businesses are the engines which drive the North American economy. Increasingly, people go in to their own business. Often spouses and other family members are in business together. Because of mutual trust and sharing which exists at the start of these arrangements, spouses tend not to make agreements about what will happen if the marriage breaks down. When spouses who are in business together divorce, there are also consequences for the business. Who will keep the business? What will the spouses be able to work together? How much is the business worth? Who should buy the business? How will a buyout be funded? These questions are just the tip of the iceberg.

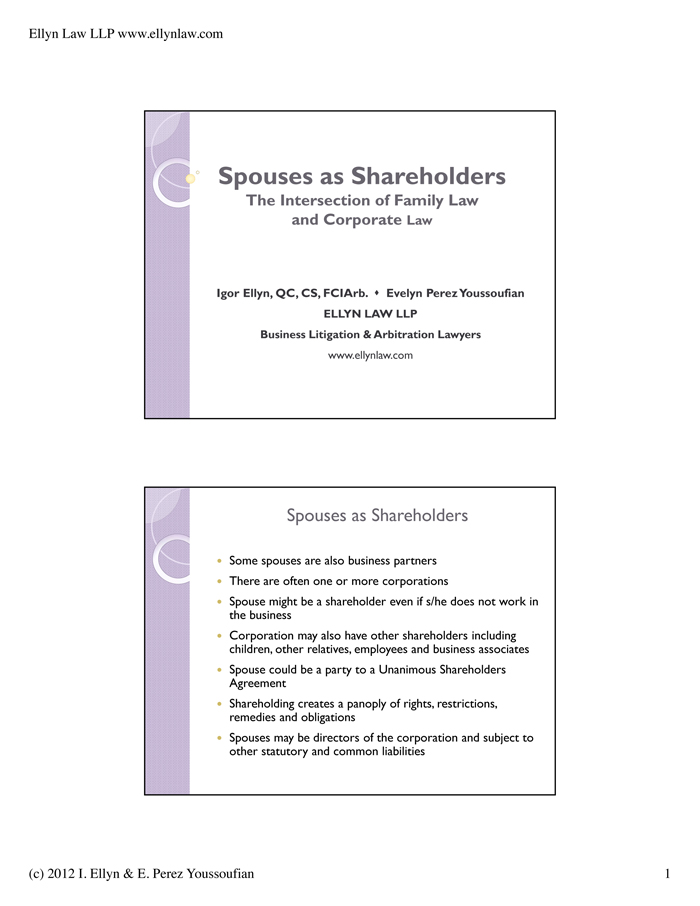

In this PowerPoint slide presentation, we provide useful information about the legal problems confronting separating or divorcing couples who are in business together. By reviewing these slides you will gain important insights about the issues lawyers have to deal with in these situations. What law applies? What other kinds of experts do you need? What legal advice will you need to find a workable resolution? What evidence will you need if the case has to go to trial? What procedure must be followed? If you are in business with your spouse or life partner, the information in these slides provides a few pointers about Ontario law even if the relationship is continuing. Sometimes, a unanimous shareholders’ agreement or some strategic advice can help avoid expensive litigation down the road.

These slides were part of a presentation at a lawyers conference conducted by Osgoode Professional Development in Toronto on March 27, 2012. They are intended as information only and not legal advice. The authors are experienced litigation and arbitration lawyers in Toronto, Ontario, Canada, who act on complex shareholder disputes, typically involving closely-held corporations.